Unlocking the Secrets of Treasury Inflation Protected Securities: A Comprehensive Guide for Prudent Investors

In today's uncertain economic climate, investors are facing the daunting challenge of preserving their wealth against the relentless march of inflation. Treasury Inflation Protected Securities (TIPS) have emerged as a potent weapon in this fight, offering a unique combination of safety, yield, and inflation protection.

4.4 out of 5

| Language | : | English |

| File size | : | 1838 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 90 pages |

| Lending | : | Enabled |

This comprehensive guide will provide you with an in-depth understanding of TIPS, empowering you to make informed investment decisions that can safeguard your financial future.

What are Treasury Inflation Protected Securities?

TIPS are bonds issued by the U.S. Treasury that protect investors from inflation by adjusting both the principal and interest payments based on changes in the Consumer Price Index (CPI).

When inflation rises, the principal value of TIPS increases, effectively preserving your purchasing power. Conversely, when inflation falls, the principal value decreases, but investors still receive the guaranteed interest payments.

How TIPS Work

TIPS are issued with a nominal value, which is the face amount that is paid back at maturity. The inflation-adjusted principal value is calculated using the CPI-U index, with a base value of 100 set at the time of issuance.

Interest payments on TIPS are made semi-annually and are based on the inflation-adjusted principal value. The real interest rate, which represents the return above inflation, is fixed at the time of issuance.

Benefits of Investing in TIPS

- Inflation Protection: The primary benefit of TIPS is their ability to protect investors from the erosion of purchasing power caused by inflation.

- Enhanced Yield: TIPS typically offer higher yields than traditional Treasury bonds because of the inflation protection premium built into their pricing.

- Low Risk: As TIPS are backed by the full faith and credit of the U.S. government, they carry a very low default risk.

- Diversification: TIPS provide diversification benefits to a portfolio by reducing correlation with other asset classes, such as stocks and bonds.

How to Invest in TIPS

Investors can Free Download TIPS through the following channels:

- Brokerage firms: Most major brokerage firms offer TIPS trading.

- Mutual funds: Several mutual funds invest exclusively in TIPS, providing investors with diversified exposure to the asset class.

- Exchange-traded funds (ETFs): TIPS ETFs provide a convenient and liquid way to invest in TIPS.

- Treasury Direct: Investors can Free Download TIPS directly from the U.S. Treasury through the Treasury Direct program.

Factors to Consider When Investing in TIPS

- Inflation Expectations: The attractiveness of TIPS depends on your expectations for inflation. If you anticipate that inflation will be high, TIPS may offer a more attractive return than traditional bonds.

- Interest Rate Risk: TIPS are subject to interest rate risk, just like traditional bonds. Rising interest rates can lower the value of TIPS.

- Liquidity: While TIPS are generally liquid, the market for individual TIPS issues can be less liquid than the market for Treasury bonds.

- Maturity: TIPS come with a range of maturities, from 5 to 30 years. Consider your investment horizon and risk tolerance when selecting the maturity of your TIPS.

Treasury Inflation Protected Securities are a valuable tool for investors seeking to protect their wealth from inflation and enhance their returns. By understanding the key features, benefits, and risks of TIPS, you can make informed investment decisions that align with your financial goals.

Whether you are a seasoned investor or just starting out, this comprehensive guide will empower you to navigate the world of TIPS and harness their potential to safeguard your financial future in an uncertain economic environment.

4.4 out of 5

| Language | : | English |

| File size | : | 1838 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 90 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia David Kadavy

David Kadavy Daniel Peterson

Daniel Peterson Daniel R Montello

Daniel R Montello Dave Chambers

Dave Chambers David Richardson

David Richardson David Wiesner

David Wiesner Daphne Hicks

Daphne Hicks Darren G Davis

Darren G Davis Danielle Roberts

Danielle Roberts David Rooney

David Rooney David L Lewis

David L Lewis Darlene A Cypser

Darlene A Cypser David Osborn

David Osborn Darryl Belfry

Darryl Belfry Daniel Prince

Daniel Prince David A Wilson

David A Wilson Darah Zeledon

Darah Zeledon Daxton Wilde

Daxton Wilde Daniel Smith

Daniel Smith Davi Kopenawa

Davi Kopenawa

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Jorge Luis BorgesUnveiling the Enchanting World of Debbie Emmett's "The Legendary Gods" |...

Jorge Luis BorgesUnveiling the Enchanting World of Debbie Emmett's "The Legendary Gods" |...

Dalton FosterUnveiling the Roots of Modern Science: A Journey Through "The Beginnings of...

Dalton FosterUnveiling the Roots of Modern Science: A Journey Through "The Beginnings of... Hugh ReedFollow ·2.3k

Hugh ReedFollow ·2.3k Phil FosterFollow ·5k

Phil FosterFollow ·5k Henry JamesFollow ·17.6k

Henry JamesFollow ·17.6k Corey HayesFollow ·19.1k

Corey HayesFollow ·19.1k Dwayne MitchellFollow ·10.3k

Dwayne MitchellFollow ·10.3k Francisco CoxFollow ·8.5k

Francisco CoxFollow ·8.5k Herbert CoxFollow ·6.2k

Herbert CoxFollow ·6.2k Oliver FosterFollow ·13.9k

Oliver FosterFollow ·13.9k

Cameron Reed

Cameron ReedHow to Know When Language Deceives You

Unmasking the Power of...

Robbie Carter

Robbie Carter50 Things To Know About Planning Home Schooling...

: The Power of Hands-On Learning Embarking...

Julio Cortázar

Julio CortázarCalculus: Single and Multivariable, 8th Edition — The...

Calculus is the...

Jaime Mitchell

Jaime MitchellBunnicula and Friends: A Spooktacular Tale of Mystery and...

In the quaint little town of Celeryville,...

Josh Carter

Josh CarterPeppa Easter Egg Hunt: Join Peppa Pig on an...

Get ready for...

Donovan Carter

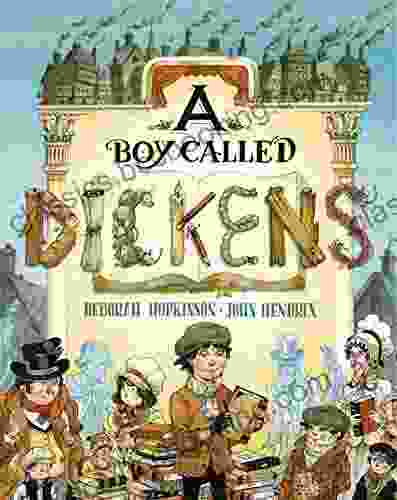

Donovan CarterBoy Called Dickens: A Journey into the Childhood of a...

Delving into the...

4.4 out of 5

| Language | : | English |

| File size | : | 1838 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 90 pages |

| Lending | : | Enabled |