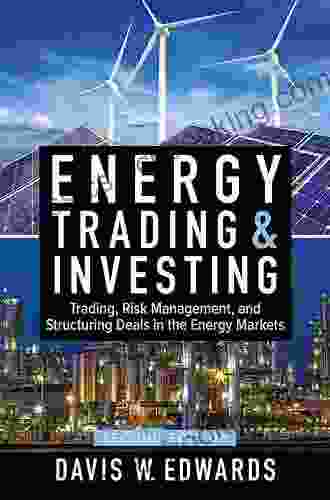

Trading Risk Management and Structuring Deals in the Energy Market: A Comprehensive Guide

The energy market is a rapidly evolving and complex landscape, presenting both opportunities and challenges for businesses and investors. Amidst this market volatility, managing risks and structuring deals effectively is paramount to navigating the complexities and maximizing returns.

4.7 out of 5

| Language | : | English |

| File size | : | 73702 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 513 pages |

In this comprehensive article, we embark on a journey into the intricate world of trading risk management and structuring deals in the energy market. We will explore the key concepts, strategies, and best practices that can empower energy professionals and investors to mitigate risks, optimize outcomes, and achieve long-term success.

Understanding Trading Risk Management in the Energy Market

Trading risk management in the energy market involves identifying, assessing, and mitigating the various risks associated with energy trading activities. These risks may stem from price fluctuations, supply and demand dynamics, geopolitical events, and market volatility.

Effective risk management strategies in the energy market typically involve:

- Market Risk Assessment: Analyzing historical data, market trends, and economic indicators to forecast potential price movements and market conditions.

- Counterparty Risk Assessment: Evaluating the financial stability and creditworthiness of trading partners to minimize the risk of default.

- Operational Risk Assessment: Identifying and addressing potential operational challenges, such as equipment failures, supply chain disruptions, and human errors.

Structuring Deals in the Energy Market

Structuring deals in the energy market involves designing and implementing contractual arrangements that define the terms and conditions of energy transactions. These deals often involve complex financial and legal considerations.

Key aspects of structuring energy deals include:

- Pricing and Settlement Mechanisms: Determining the pricing formula, payment terms, and settlement procedures for energy contracts.

- Contractual Terms and Conditions: Specifying the rights, obligations, and liabilities of the parties involved in the transaction, including delivery schedules, quality specifications, and default provisions.

- Risk Allocation and Mitigation: Assigning risk responsibilities among the parties and employing hedging strategies to reduce exposure to price fluctuations.

Energy Derivatives and Hedging Strategies

Energy derivatives, such as futures, options, and swaps, play a crucial role in managing risks and optimizing returns in the energy market. These financial instruments allow market participants to hedge against price volatility and lock in future prices.

Common hedging strategies in the energy market include:

- Forward Contracts: Committing to buy or sell a specific quantity of energy at a fixed price in the future.

- Options Contracts: Acquiring the right, but not the obligation, to buy or sell energy at a specified price within a certain time frame.

- Swap Contracts: Exchanging cash flows based on different energy price indices or reference prices.

Market Analysis and Forecasting

Thorough market analysis and forecasting are essential for informed decision-making in the energy market. This involves monitoring market trends, studying economic indicators, and utilizing quantitative and qualitative analysis techniques.

Key elements of energy market analysis include:

- Supply and Demand Analysis: Assessing the balance between energy production, consumption, and storage capacities.

- Geopolitical Analysis: Monitoring global events and political developments that may impact energy supply and demand.

- Economic Analysis: Evaluating economic growth, inflation, interest rates, and currency fluctuations that can affect energy markets.

Navigating the energy market effectively requires a deep understanding of trading risk management and deal structuring. By employing comprehensive risk assessment techniques, utilizing energy derivatives for hedging, conducting thorough market analysis, and structuring deals that align with strategic objectives, energy professionals and investors can minimize risks, optimize returns, and achieve sustainable success.

The book "Trading Risk Management and Structuring Deals in the Energy Market Second" delves into these concepts in greater detail, providing a comprehensive guide to navigating the complexities of the energy market. This invaluable resource empowers readers with the knowledge and strategies necessary to mitigate risks, maximize opportunities, and excel in this dynamic and ever-evolving industry.

Whether you are a seasoned energy professional or an investor seeking to expand your knowledge, this book is an essential addition to your library. Its insightful content and practical guidance will equip you to navigate the challenges and capitalize on the opportunities presented by the energy market.

4.7 out of 5

| Language | : | English |

| File size | : | 73702 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 513 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Davida Hartman

Davida Hartman David Tracey

David Tracey David Henry Sterry

David Henry Sterry David Stark

David Stark Daphne Oz

Daphne Oz David A Kelly

David A Kelly David Greenberg

David Greenberg David A Mcintee

David A Mcintee David Nees

David Nees De Andrea

De Andrea David C Tucker

David C Tucker Debby Detering

Debby Detering David Mikics

David Mikics David Lawrence

David Lawrence David Hare

David Hare David Elwyn Morris

David Elwyn Morris David A Moss

David A Moss David Lusted

David Lusted David Klausmeyer

David Klausmeyer Danny Meyer

Danny Meyer

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Theodore MitchellPoison Arrows: The Deadly Weaponry of North American Indians in Hunting and...

Theodore MitchellPoison Arrows: The Deadly Weaponry of North American Indians in Hunting and... Jayson PowellFollow ·6.1k

Jayson PowellFollow ·6.1k Chandler WardFollow ·3.4k

Chandler WardFollow ·3.4k Douglas AdamsFollow ·18.5k

Douglas AdamsFollow ·18.5k Matt ReedFollow ·2.6k

Matt ReedFollow ·2.6k Ricky BellFollow ·7.3k

Ricky BellFollow ·7.3k Mark MitchellFollow ·13.9k

Mark MitchellFollow ·13.9k Hugh ReedFollow ·2.3k

Hugh ReedFollow ·2.3k Salman RushdieFollow ·13.3k

Salman RushdieFollow ·13.3k

Cameron Reed

Cameron ReedHow to Know When Language Deceives You

Unmasking the Power of...

Robbie Carter

Robbie Carter50 Things To Know About Planning Home Schooling...

: The Power of Hands-On Learning Embarking...

Julio Cortázar

Julio CortázarCalculus: Single and Multivariable, 8th Edition — The...

Calculus is the...

Jaime Mitchell

Jaime MitchellBunnicula and Friends: A Spooktacular Tale of Mystery and...

In the quaint little town of Celeryville,...

Josh Carter

Josh CarterPeppa Easter Egg Hunt: Join Peppa Pig on an...

Get ready for...

Donovan Carter

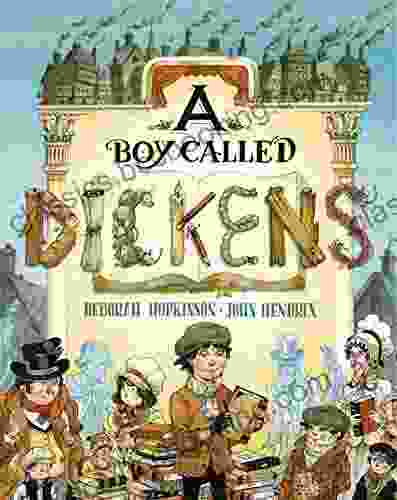

Donovan CarterBoy Called Dickens: A Journey into the Childhood of a...

Delving into the...

4.7 out of 5

| Language | : | English |

| File size | : | 73702 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 513 pages |